Fund in USD/EUR and deliver GHS to Ghanaian bank accounts or major mobile wallets. Transparent FX, lean processing, and tracking from quote to arrival.

Low processing costs

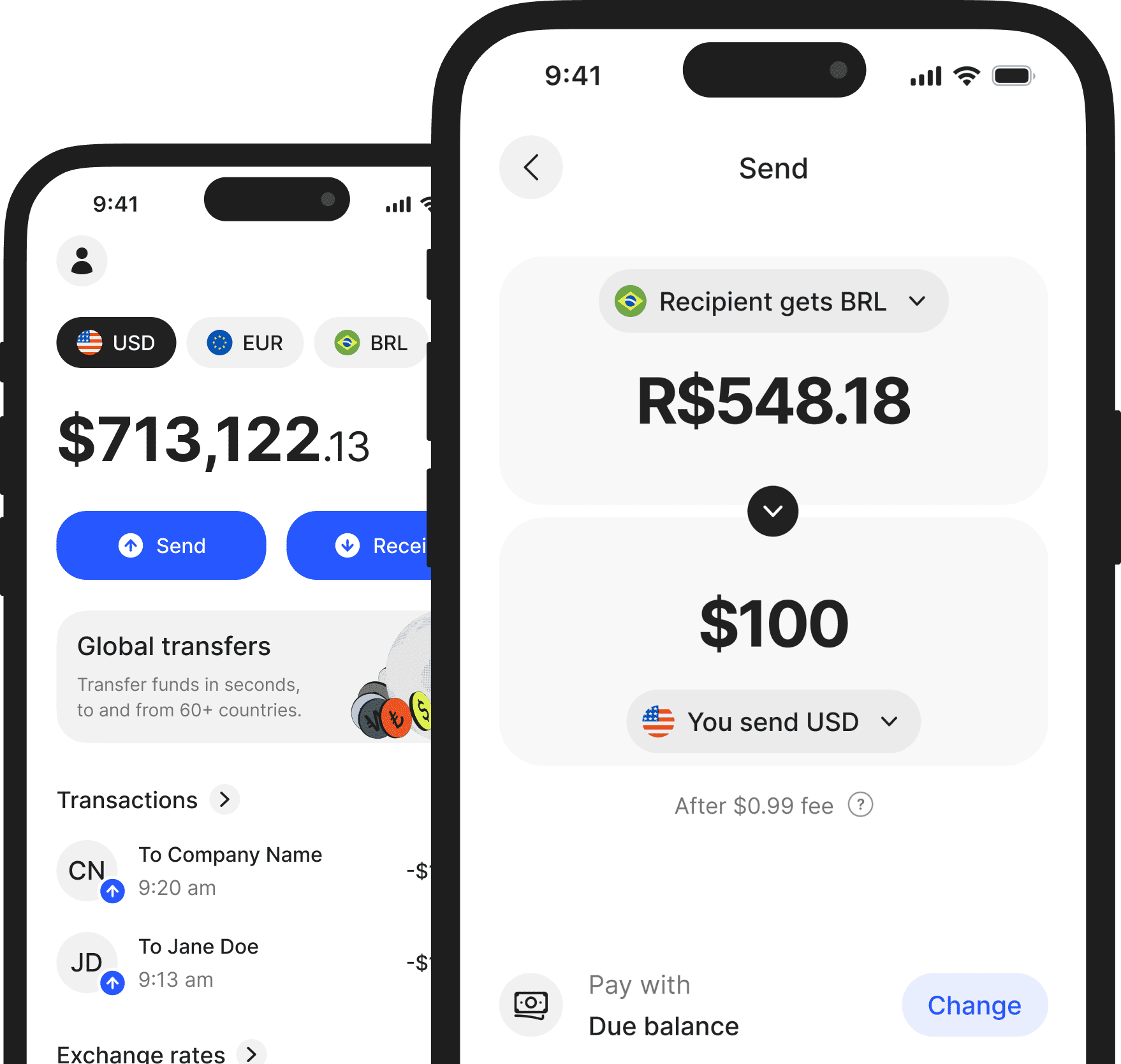

Send and receive money globally for under 0.5%, compared to the 4–6% charged by traditional processors, helping you keep more of what you earn <0.5%.

Instant transfers

Enjoy real-time settlements in USD, GHS, or stablecoins, with most payments processed instantly or within 24 hours faster than banks or remittance apps.

Transparent FX rates

Get honest, market-aligned exchange rates for the Ghanaian Cedi and other currencies. No hidden fees, no inflated spreads, just Fair FX every time.

Flexible funding

Top up your Due account seamlessly using bank transfers, mobile wallets, or stablecoins. Move your funds the way that suits you best.

Virtual account numbers

Access local banking details in major currencies to receive payments, convert funds at fair rates, or withdraw in Ghanaian Cedi (GHS) whenever you need.

Non-custodial security

Your money stays fully protected and self-owned, thanks to biometric authentication and secure, non-custodial wallet technology.

Mobile money

Send GHS instantly through mobile money providers available nationwide.

Local bank transfers

Transfer to Ghanaian bank accounts via domestic payment rails for same-day settlement.

SWIFT international transfers

Send USD, EUR, or GBP globally through SWIFT with transparent FX and full tracking.

Stablecoin transfers

Fund in USDC, USDT, or EURC, convert at institutional FX, and settle locally in GHS.

Real‑time payment methods

Use local payment channels for fast domestic transfers, settling within 24 hours.

Mobile wallets

Pay with digital wallets for fast, convenient cross-border transfers.

Mobile money

Receive GHS instantly through mobile money services available nationwide, accessible 24/7.

Local bank transfers

Get funds to your Ghanaian bank account via domestic payment rails, cleared in real time or same day.

SWIFT international transfers

Receive USD, EUR, or GBP through SWIFT, converted at transparent FX rates.

Stablecoin transfers

Accept USDC, USDT, or EURC instantly on supported blockchains. Hold as stablecoins or convert to GHS.

Real‑time payment methods

Collect funds through local payment channels for fast transfers, settling within 24 hours.

Virtual accounts

Accept overseas payments in EUR, GBP, and USD via local rails. Settlement in T+1 to T+3 days. GHS virtual accounts coming soon.

Global compliance & trust you can always rely on

Licensed & regulated

We follow strict financial regulations, so your transfers meet international compliance standards.

KYC & AML protection

All accounts are verified to prevent fraud, ensuring your money moves safely and legally.

Data privacy first

Our processes align with international banking and payment rules, giving you trusted worldwide access.

Transfer money worldwide at internet speed with stablecoins – fast, simple, and secure in just three steps.

Open your account

Complete onboarding/KYC to enable USD/EUR funding and GHS delivery.

Fund & lock your quote

Top up by bank or stablecoins; confirm the real-time rate before you send.

Send money

Choose GIP or Mobile Money, add recipient details, and track every hop to completion.

FAQ: sending money to Ghana

Yes, Due can route to MTN MoMo, Vodafone Cash, and ATMoney via the national MMI switch; otherwise, use bank delivery over GIP.

Mobile-money payouts typically complete in minutes; GIP is real-time for bank-to-bank. SWIFT deliveries into Ghana are 1–3 business days on clean corridors.

Recipient name and wallet number (phone). For bank payouts: beneficiary name, bank, account number, and any required codes. Due validates formats in-flow.

Spread 0.2–0.7%. Processing 0.2–0.3% for cross-border B2B; <1% for merchant processing—quoted before you send.

Yes, MMI enables wallet↔wallet across providers and wallet↔bank/e-zwich transfers nationwide.

%20-%20Partnership%20-%20Due%20%2B%20Solana%20-%20V1.png)

.jpg)